Experts for German-Finnish tax law

Your Finnish-German tax consultancy in Germany

tax law

We offer tax consultancy services for individuals in Germany., including preparation of tax returns, tax assessment reviews, and potential tax appeals.

accounting

We provide accounting and financial services to German subsidiaries of Finnish companies, including payroll, accounting, annual financial statements, and tax returns.

social security audits

Our team of experienced professionals provides personalized support to ensure that our clients’ businesses are fully compliant with regulations and requirements.

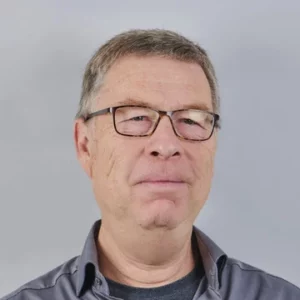

Steuerberatung Trosien

Navigate the complex German and Finnish tax systems with ease

Steuerberatung Trosien was founded in 2004 and is a tax consultancy based near Frankfurt/Main, Germany.

Our experts offer tax consultancy services in Germany, including tax returns, planning, and appeals for individuals, as well as financial and accounting services for German subsidiaries of Finnish companies. We also provide consultation for setting up new companies in Germany, supervise tax and social security audits, and manage company bank accounts.

Contact us for tailored solutions and personalized service to help you achieve your financial goals.

Preparing tax returns, tax assessment reviews and potential tax appeals for individuals in Germany

At Steuerberatung Trosien, we offer expert tax consultancy services for individuals in Germany. Our services include preparing tax returns, tax assessment reviews, and potential tax appeals. We understand that individual and family tax planning is a critical part of managing personal finances, which is why we take a careful and comprehensive approach to each case. Our team is knowledgeable in the determination of (inter-)national income, ensuring that our clients’ taxes are accurate and aligned with their financial goals.

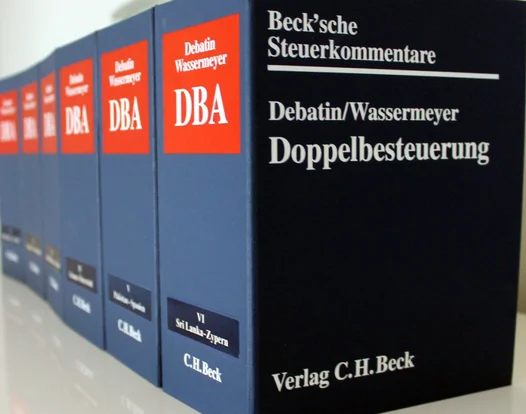

Services and consultations in the field of Finnish-German tax law

We understand that navigating the complex world of tax law can be overwhelming for businesses. That’s why we offer consultations on issues such as the foundation of a permanent establishment and PAYE (“pay as you earn”) taxation, among others.

We work closely with our clients to ensure that they understand the implications of these issues and can make informed decisions that align with their financial goals. Our team of experts is always up-to-date on the latest changes in tax law, ensuring that our clients receive the most current and accurate advice.

Accounting and other financial services for German subsidiaries of Finnish companies

We provide comprehensive accounting and financial services to German subsidiaries of Finnish companies, including payroll, accounting, annual financial statements, and tax returns. Our team of experts ensures compliance with German laws and regulations, and we are dedicated to helping our clients succeed in the German market.

Payroll

In addition to payroll accounting and instructing salary payments, our payroll services also include social security and other statutory compliance.

Accounting

Our accounting service include German statutory obligations, a personal accountant and preparing financial reports according to our clients individual needs.

Annual financial statements

The German accounting requirements deviate somewhat from the Finnish laws and requirements. Our job is to ensure that our clients’ annual financial statements are in compliance with current laws and regulations.

Tax returns

Company tax returns require properly prepared accounts and good accounting practice. In Germany, a minimun of three different tax returns are needed to be filed by any company each year.

Establishing a new company or subsidiary in Germany

Our team is specialized in tax law, which allows us to provide our clients with expert guidance and support when establishing a new company or subsidiary in Germany. We are knowledgeable in the latest regulations and requirements, ensuring that our clients’ businesses are set up for success from day one. With our personalized approach and attention to detail, we provide tailored solutions that meet the unique needs of each client. Contact us today to learn more about how we can help you establish a strong foundation for your new company or subsidiary in Germany.

Supervising, advising and finalising tax and social security audits in Germany

Social security audits can be a daunting and time-consuming process for businesses. That’s why we offer expert supervision, advice, and finalization services to guide our clients through each step of the audit process in Germany. Our team of experienced professionals provides personalized support to ensure that our clients’ businesses are fully compliant with regulations and requirements.

While audits by tax authorities may not happen to every company, every employing company is audited regularly by the social security inspectorate, which is why we are committed to providing our clients with the necessary support and guidance to ensure a smooth and successful audit process.

Contact us today to learn more about how we can help you achieve your financial goals.

Our experienced team

Lina

Our lovely office dog